Collaborative Carousel: Nutresa Group

Carrusel Colaborativo: Grupo Nutresa

Eberto Zuniga Rodriguez ezuniga@alimentoscarnicos.com.co

Business Administrator, MBA, MLI candidate. Alimentos Cárnicos SAS (Grupo Nutresa).

Guillermo Márquez Ferro gmarquezf@uninorte.edu.co

Industrial Engineer, M.A. Management. Universidad del Norte

Gloria Mercedes López Orozco gmlopez@uao.edu.co

Industrial Engineer, Integrated Logistics Specialist, MSc in Logistics and advanced models for operations management and supply chain management, Doctor in Industrial Engineering. Universidad Autónoma de Occidente

Abstract

By the year 2005, the meat business sector formed by "Rica Rondo S.A.", "Industria Nacional de Alimentos S.A.", "Suizo S.A."," Zenú S.A.", and "Almacenes La 14 S.A." started a new strategic alliance aiming to increase their supply chain efficiency, a strategy they named "Collaborative Carousel". Their main goal was to improve delivery times, reception and assortment of of brands such as: "Zenú", "Rica Rondo", and "Suizo" in the ten "Almacenes La 14 S.A." stores, looking forward to ensure the best service for the final consumer. The result of this experience helped generate a collective knowledged, which allowed everyone to identify improvement opportunities in their logistics operations. This article presents a success story based on the application of the principle of collaboration in last mile processes. The methodology used corresponds to the narrative case method, presents the business evolution of several businesses, accounts for the success of the collaborative carousel type articulation process (step by step), which links resources, actors, interests, culture, and results.

Keywords: Keywords: Improvement Logistics chain, Grupo Nutresa, Supply Chain Continuous Resupplying (CPR), and Efficient Consumer Response (ECR), Collaborative Planning, Forecasting and Resupply CPFR, learning logistical processes.

Resumen

En el año 2005, el Negocio Cárnico conformado por las empresas, Rica Rondo Industria Nacional de Alimentos S.A, Suizo S.A e Industria de Alimentos Zenú S.A y Almacenes La 14 S.A, crearon una alianza estratégica con miras a incrementar la eficiencia en la cadena de abastecimiento a la que denominaron: "Carrusel Colaborativo". Su principal objetivo fue el de mejorar los tiempos de pedido, recibo y surtido de los productos de las marcas Zenú, Rica y Suizo en los diez puntos de venta de Almacenes La 14 S.A., con el fin de ofrecer un mejor nivel de servicio al consumidor final; el resultado de esta experiencia y que sirvió de aprendizaje colectivo, permitió a las partes identificar oportunidades de mejora en las operaciones logísticas. El articulo presenta un caso de exito con base en la aplicación del principio de colaboración en los procesos de última milla. La metodologia utilizada corresponde al metodo de caso narrativo, presenta la evolución empresarial de varios negocios, da cuenta del éxito del proceso de articulación (paso a paso) tipo carrusel colaborativo, que vincula recursos, actores, intereses, cultura y resultados.

Palabra clave: mejoramiento de la cadena de suministros, Grupo Nutresa Improvement Logistics chain, Grupo Nutresa, reabastecimiento continuo de la cadena de suministro (CPR), respuesta eficiente del consumidor (ECR) y planificación colaborativa, pronóstico y reabastecimiento (CPFR) y aprendizaje de procesos logísticos..

Fecha de recepción: 17 de diciembre de 2020. Fecha de aceptación: 15 de noviembre de 2022

1. INTRODUCTION AND BACKGROUND

The Collaborative Carousel between the Negocio Cárnico (1) from the Nutresa Group (2) and Almacenes La 14 S.A. is an alliance to improve delivery time, reception, and product portfolio within the supply network.

In November 2004, the head of Distribution Logistics at Rica Rondo Industria Nacional de Alimentos S.A., Eberto Zúñiga, and the director of Logistics Management at La 14 S.A., Abel Cardona, met in the city of Santiago de Cali, with the purpose of finding alternatives to improve the logistics connectivity of the companies to achieve efficiency in delivery times, reception, and meat product portfolio at the supermarket chain outlets.

This meeting was held after Inveralimenticias Noel S.A. acquired the company Rica Rondo, Industria Nacional de Alimentos, in July 2002.

Later, in September 2004, they both participated in the International Congress of Logistics Managers, organized by the National Association of Entrepreneurs, ANDI, Valle del Cauca branch (3). On this occasion, the participating companies presented successful cases of collaboration as generation of competitive advantages in the relationship between customer and supplier in the supply chain.

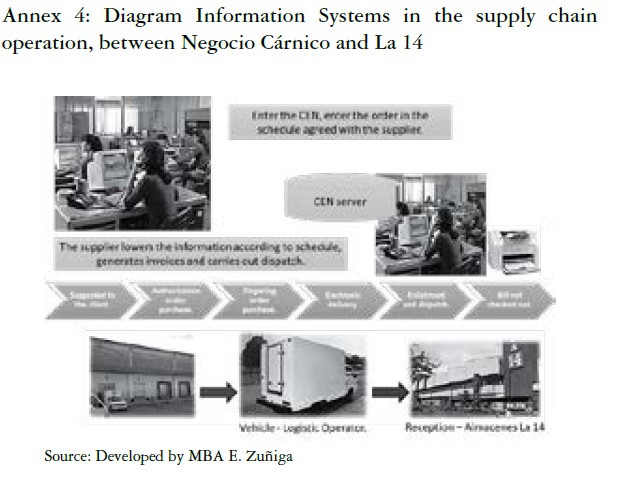

With the conferences, Zúñiga and Cardona were able to understand that the topics were similar to the problems that had them in their companies and that they could, therefore, work together and take advantage of the reality they were living. Motivated by the changes in connectivity issues that the market had been experiencing, through electronic data interchange, EDI(4), and the CEN (Centro Electrónico de Negocios)(5), the research, development, and handbooks from the Institute of Automation and Commercial Coding, IAC - LOGYCA,(6) on good logistics practices, were mandatory to be at the forefront, since similar customer-supplier relationships in the sector were showing significant advances in this field.

The ties between the representatives of the companies became stronger, and, through a pilot carried out in January 2005 in one of the Almacenes La 14 S.A. stores, confidence was strengthened and an improvement in delivery times, reception, and meat product portfolio was obtained. The final evaluation of each of the common activities was very important for the companies that progressively facilitated new pilots up to formalize the concept of the Collaborative Carousel, (7) supported by the certified delivery program of GS1, Colombian Bar Codes, administered via Logyca.

However, and with all the tangible progress achieved and presented to the corporate boards, there were restrictions on the internal audit areas of the organizations to formalize the agreement. For them, this new practice did not fit with the strategy proposed for each of the businesses.

Almacenes La 14 S.A. was a leading supermarket chain in Valle del Cauca. (8). The Cardona family began their business history with a grocery store in Aguadas, Caldas, which was attended by Abel Cardona and his son Jaime, who at the age of 14 became interested in the business.

In 1952, the Cardona family settled in the city of Santiago de Cali, where Abel Cardona and Antonio Villegas founded a small store, which opened to the public on 14th Street. During the first year, the business lost money and Antonio Villegas sold his share to Cardona, who, with the help of his children, Jaime and Gustavo, took over the business and managed it to generate profits.

Soon after, a merchant by the name of Benicio Mejia offered the Cardona family his china shop (9) called La 14, from where the name came. The business operated as a trading establishment until 1963, when it was transformed into a limited company.

Several years passed, and the small business was transformed into Almacenes La 14 S.A., an important chain of supermarkets, leader in the southwestern area of the country, and with national projection, having 16 stores in Cali, five more in the municipalities of Jamundí, Palmira, Buenaventura, Tuluá, and Yumbo, within the region. At the national level, it extended its operation to the cities of Bogota, Pereira, Armenia, and Manizales; with a total of 26 supermarkets throughout the country. Its administrative headquarters were located in the Calima Commercial Center, in the city of Cali.

Their constant growth allowed them to offer an excellent service to more customers nationwide; under this premise, they inaugurated their first supermarket in the city of Bogotá in 2011. Its expansion plan was oriented to the design of new supermarkets for the cities of Armenia and Neiva, while other possibilities were analysed in Bogotá, Ibagué, Girardot, Cali, and Palmira, where they projected others "Calima Shopping Center" with one La 14 store.

What they organized in these years turned, by year 2013, into one of the great generators of employment at a national level, with 4.954 direct collaborators, and more than 9.000 allies, their main strength.

Rica Rondo, Industria Nacional de Alimentos S.A., meanwhile, was a leading company in the cold meat business of the Colombian Southwest, and the second largest brand in the country. (10)

In 1968, in Santiago de Cali, the company Rica Rondo, Industria Nacional de Alimentos S.A. was born, product of the union of four partners who, with the vision and enthusiasm of their president, William B. Murray, obtained, in a short time, prestige as an innovative company, based on the quality of its products and good service to its customers. Its image was consolidated in 1971, when Rica Rondo obtained, from the Organizing Committee of the VI Pan American Games, the contract to supply 40,000 pounds of sausage products to feed the athletes participating in the event.

Since the beginning, the company stood out for its solidity in the quality of its employees and its good internal working environment. This basic heritage, together with an excellent brand management and the gradual integration of a large distribution network, generated a business culture of work, dedication, and commitment that the market recognized. It also served as an example for the entire Colombian industry. This condition allowed it to permanently to be placed in the list of the most important companies in Colombia.

The company was also distinguished by its customer orientation from its marketing strategies and by having an open and participatory work environment, which evolved to total quality control.

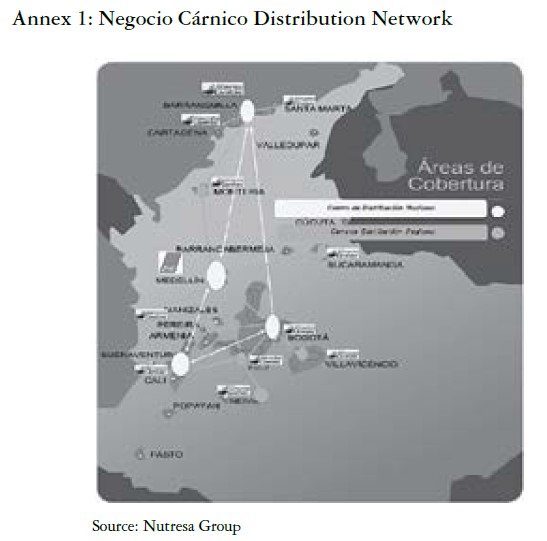

Since its inception, it has developed and distributed more than 100 product references and covered the entire Colombian territory, through seven regional sales units called districts, which had specialized sales management heads for each distribution channel, key account executives, and the support of the respective distribution centers, CEDIS. See Annex No.1, Negocio Cárnico Distribution Network. In 1995, the Planning Area of the company projected that it would require new facilities in the year 2000, due to the expected growth in the market. This was how the need to build a new production plant with all the technical specifications, where the productive and environmental activities were harmoniously developed, arose. At that time, Law 218 of 1995, known as the Páez Law, was enacted, bringing very good fiscal benefits.

In December 1996, a lot was purchased at Parque Industrial y Comercial del Cauca, Caloto and with the legal name Frigorifico del Sur S.A. The construction of the new plant began in July 1998 and raw construction materials and manpower from that region were used.

One of the most difficult moments in the company's history occurred in 1998, due to the implementation of an enterprise resource planning system (ERP) (11), which, in its initial stage, did not properly work and generated distribution inefficiencies, as well as in the finance and manufacturing modules. The system did not allow for adequate compliance with the order billing, and it presented a total deficiency in the generation of information on such topics as inventory control, production planning, and accounts receivable and payable. This led to a 4% drop in market share in the April-May 1998 period.

Only until the fourth quarter of the same year did the ERP began to produce benefits by allowing control over management indicators and offering initial advantages such as: computer terminal for the sales force to take customer orders, online and updated data for devolutions, missing products, financial and volume discounts, and production planning. By October 1998, a cost and expense reduction program was implemented.

Between 1999 and 2001, Rica Rondo, Industria Nacional de Alimentos S.A. began with the operating process of cold rooms and blend preparations. The canning area was moved to the facilities of Frigorifico del Sur S.A., which allowed for an increase in the utilization of the installed capacity of the latter. The company advanced contacts with investors interested in acquiring 100% of the shares of Frigorifico del Sur S.A., which, at the end of the year, signed a sales contract with Inveralimenticias Noel S.A.

Between 2002 and 2008, the company became part of the Inveralimenticias S.A. Group, later, of the food sector of the Nacional de Chocolates S.A Group, and, finally, from 2013, of the Nutresa Group,

In 2008, the plant of Frigorífico del Sur S.A. was merged with the companies Rica Rondo S.A., Suizo S.A., Frigorifico Continental S.A., Tecniagro S.A., Proveg Ltda., and Mil Delicias, thus consolidating the company Alimentos Cárnicos S.A., leading operation in the cold meat market in Colombia, which sought to boost its resources and to homologate processes aimed at the central objective of the business, which was to grow revenue.

By 2013, the plant of Alimentos Cárnicos S.A.S., located in the municipality of Caloto, department of Cauca, generated more than 230 direct and indirect jobs and had a capacity of more than 900 tons per month of products.

Zenú, a Brand with 50 Years of History (12)

Zenú was founded in Medellin in 1957, when the meat process was limited to cutting and dispensing; when there were only small artisan factories producing 'chorizos' that were transformed into the production of sausages.

Eduardo Ospina was an entrepreneur and visionary, who under the encouragement of his father, Pedro Nel Ospina, designed a modern plant to produce processed meats with equipment imported from the United States, and under the advice of a German technician called Matias Brass.

In 1957, with 50 employees, the Zenú product company dedicated itself to the production of canned meat, such as Vienna sausages, Frankfurt sausages, liver paste, deviled meat, and ham. During its first year, production reached 12,000 cans a day. In 1959, and with great acceptance from its customers, a system to open cans more easily and safely was presented, to the market, as an innovation.

In the sixties, Zenú was acquired by the company Industrias Alimenticias Noel S.A., which brough a modernization of the equipment, an increase in the number of operators, and a greater demand for quality controls, attributes characterizing the company's processes. In the same period, Zenú inaugurated, in Medellin, the first tasting center open to the public, in which they presented to consumers all the variety of their products, when they announced their new presentations. They also educated consumers on nutrition.

By the 70s, the company was granted a sanitary operating license to sell its sausage and canned products throughout the national territory, and, also, to export. The automation of the key processes of the production plant began in 1974; it became the first Colombian company to use vacuum packaging for its end products, which facilitated marketing and conservation. It also improved its in-store presentation to consumers. Then, in the year of 1975, the production of the company allowed it to cover the national territory and to export to Peru, the Antilles, and Curaçao.

By the 80s, the production volume was estimated at 50 tons per day, with more than 80 references between cold meats and canned products, including peas, beans, and asparagus, among others. In this same period, the company became an example for the management of human talent, by successfully forming integration groups in the work philosophy that invited the staff of the same area to identify, analyze, investigate, and solve daily issues that arose at work. In 1988, by decree of the National Government, Zenú was awarded the National Quality Award, a stimulus that exalted the organization in its technological and industrial development.

Industria de Alimentos Zenú S.A.S., Sociedad por Acciones Simplificada, with indefinite duration and principal domicile in Medellin, Antioquia. Its social purpose was to exploit the food industry, in general, and substances used as ingredients in food, especially meat, including the processing and use of by-products from other sectors.

In addition, the social purpose of the company included the investment and application of resources or availabilities under any of the associative forms authorized by law, and the performance of any other lawful economic activity.

Suizo Arrived in Colombia in the Early Thirties (13)

José Krucker, a Swiss immigrant, arrived in Colombia at the beginning of the 30s, and began the assembly of a delicatessen named Salsamentaria Suiza, located in the city of Bogotá. This company specialized in hamburger sales. In 1970, it was incorporated as a public limited company of a commercial nature, named Frigorifico Suizo S.A., an entity with 100% Colombian capital. By this time, the Krucker family shifted all their economic interests to the new shareholders and laid the groundwork for developing a large industry.

Between 1970 and 1992, Frigorifico Suizo S.A. began a process of growth, diversification, and technological improvement, until it became one of the most important cold meat processing companies in the country. From 1993 onwards, its corporate name was changed to Suizo S.A. From this date, its sales volume, commercial coverage, patrimonial situation, and volume of employed labor allowed it to become one of the largest and most important meat sector companies in Colombia.

Looking for a consolidation process that would allow Suizo SA to achieve better levels of competitiveness in the sector, in 2008, it joined six more companies of the Negocio Cárnico (14) of the Grupo Nacional de Chocolates to form a new company: Alimentos Cárnicos S.A.S.

Alimentos Cárnicos S.A.S.

As of January 2008, the history of Alimentos Cárnicos S.A.S. was interpreted and summarized within the organization as a "sum of successes, tenacity, dedication, and business development, which made the company a benchmark for growth for the food industry in Colombia" (15).

The organization was constituted by the integration of a series of companies that were acquired by the Inversiones Nacional de Chocolates Group in a certain period of time, as a result of its strategy to grow, not only through the successful execution of its routine tasks, but also through its policy of acquisitions of established businesses, having some affinity in their production and distribution processes.

At the beginning of 2008, the creation of Alimentos Cárnicos S.A.S., which integrated the companies Rica Rondo S.A., Suizo S.A., Frigorifico Continental S.A., Frigorifico del Sur S.A., Tecniagro S.A., Proveg S.A., and Productos Mil Delicias S.A.

In 2009, as a result of some governmental changes and market dynamics, Alimentos Cárnicos S.A. was transformed, on the March 17th, 2009, by the unanimous decision of the Shareholders' Meeting, into a Simplified Share Company, (S.A.S.), with indefinite duration and principal domicile in the city of Yumbo, Valle del Cauca.

During 2010, all this patrimony, along with the skills of the Inversiones Nacional de Chocolates Group regarding brand management, and the consolidation of a powerful distribution network, allowed Alimentos Cárnicos S.A. to work with an on-line production processes in its different plants, with high technology in its logistic processes and operationally integrated with the other company of the Negocio Cárnico, known as Industria de Alimentos Zenú S.A.

By 2011, by decision of the shareholders' meeting, the parent company changed its corporate name from Grupo Nacional de Chocolates S.A. to Grupo Nutresa S.A. The new company continued to develop its corporate purpose under the new name; since then, also Alimentos Cárnicos S.A.S. became part of the Negocio Cárnico of Grupo Nutresa.

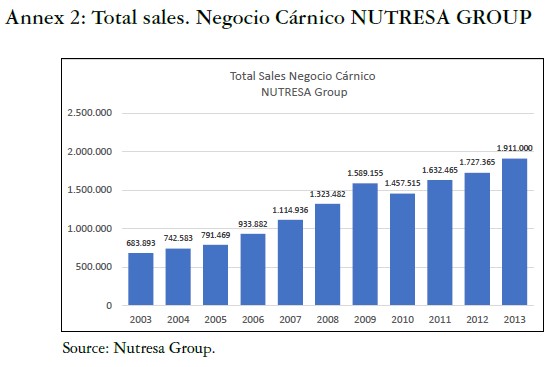

Between 2011 and 2012, they continued working in online production processes, specialized plants, and, with the best technology for the logistic process seeking the satisfaction of consumers, development of human talent, strengthening innovation, better corporate performance and leading brands, with the aim of fortifying the Negocio Cárnico and tripling its profitability by 2015.

Negocio Cárnico, a Strategic Alliance.

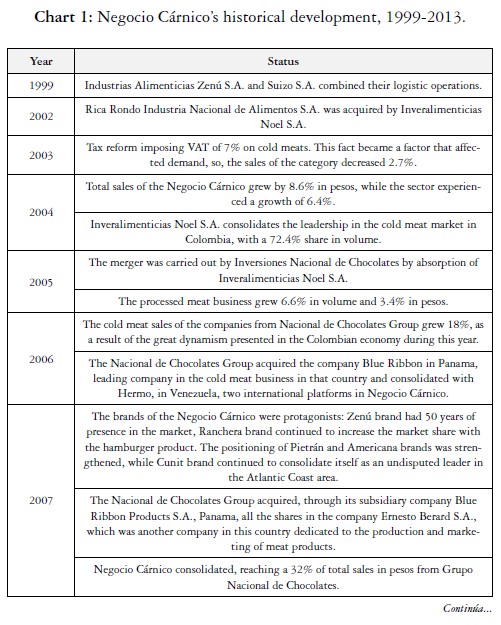

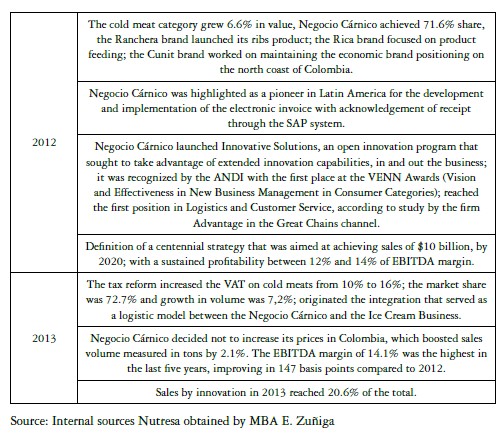

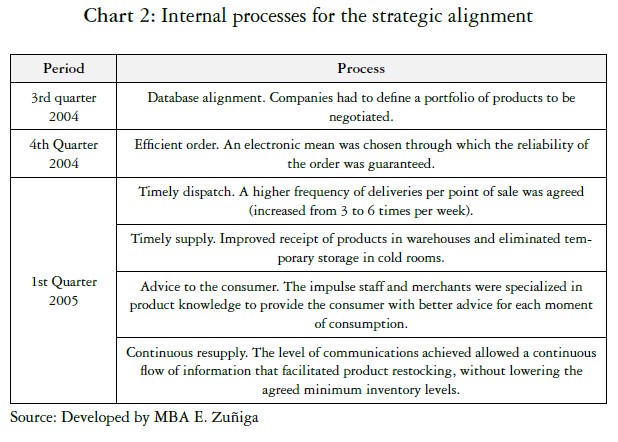

The Nacional de Chocolates Group, which later became the Nutresa Group, visualized the reorganization of its companies in Negocio Cárnico through a consolidation process that allowed it to have better levels of competitiveness, and it helped consolidate as the most important organization in production, distribution, and marketing of cold meats in Colombia. Everything was achieved as a result of the different synergies between the companies, thus strengthening their business, financial, productive, and logistic processes, but, above all, they were able to protect their national trademarks from the possible entry of international trademarks and companies. Below, we find the main facts of Negocio Cárnico's historical development between the years 1999 and 2013. Please see Chart 1 at the end of the article.

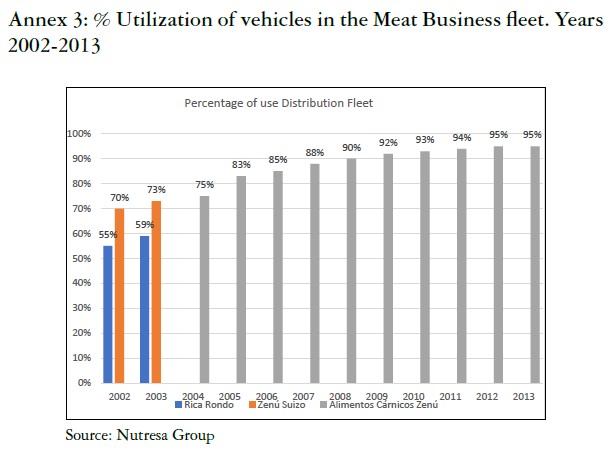

Before the strategic alliance was started between the companies that formed the Negocio Cárnico of the Nutresa Group, the companies acted independently in the same market, competing with very high operating costs, in distribution, administration, and marketing. The production was done by brand, depending on the geographic location of the parent factory, and, from there, distributed to the whole country with very expensive reverse logistics (16). When operationally joined, the percentage of utilization of the fleet of vehicles went from 60% to 95%. (See Annex No.3, % Utilization of vehicles in the Meat Business fleet. Years 20022013).

Negocio Cárnico had a mission to profitably grow with leading brands, superior service, and an excellent national and international distribution. Its products were known for having high standards of quality, innovation, and customer service (17). Its main customers were chain outlets (18), independent supermarkets (19), distributors (20), wholesalers (21), and neighbourhoods' shops (22).

Within the distribution of Negocio Cárnico, the integration of logistic operators stood out and yielded economic benefits to the company in terms of cost reduction. Additionally, a software for demand management, tracking, and customer care was implemented, as did management programs that improved the supply coverage and presence of products within the Colombian market.

The advertising investment facilitated the strengthening of new brands such as Ranchera, Pietrán, Zenú, Americana, Rica Pollo, and Cunit. The performance of these brands was characterized by the innovations of their products.

The integration process made it possible to place orders through EDI (Electronic Data Interchange), under the CEN (Electronic Data Centre) (23) platform, which facilitated the alliance more effectively (See Annex No.4, Diagram Information Systems in the supply chain operation, between the Meat Business and La 14). The companies integrated the entire logistics operation, this was translated into benefits for the company and customers, who from that moment could carry out purchases in a centralized fashion. However, the companies were conceived independently by their customers, thereby affecting distribution costs. In view of the above, Negocio Cárnico saw the need to seek partners to develop a strategy to solve the problems in an efficient manner; then, they sought to approach the largest and most representative customer of the department of Valle del Cauca: Almacenes La 14 S.A.

Strategic Alliance Between Negocio Cárnico and Almacenes La 14 S.A.

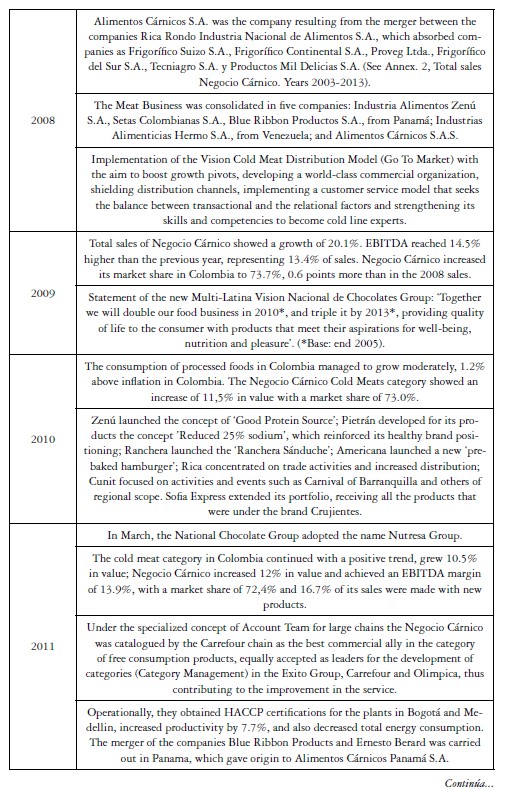

During 2004, fallacies in the logistical process that were affecting the quality of customer service were identified. To achieve strategic alignment, companies had to adjust the following processes. Please see on Chart #2 at the end of the article.

A key factor in this adjustment process was the electronic exchange of data, due to the fact that negotiations between Negocio Cárnico and La 14 S.A. made it possible to increase revenues by making the collection process through electronic invoices more efficient. Costs were also reduced by improving supply chain coordination and forecasting the interrelationship between supply and demand.

"Purchase orders were manually placed, and billing was completed at 9:00 p.m": Victor Hugo Molina Charry, Logistics Coordinator for Meat Business Distribution.

Prior to, and during 2005, the sponsors of Negocio Cárnico and La 14 S.A., as a result of joint action, and acting as an open book (knowledge of needs, management of opportunities, and proposals for joint solutions for companies), and as an exercise in the results from the pilot tests carried out, had to choose to look at the consumer on the same side of the table, thus, it was necessary to speak the same language and look for, as a team, for the best alternatives to satisfy it. They had to agree on common measurement elements, as the parties initially calculated their indicators differently and this led to some degree of discomfort, because positions were entrenched. The company functional areas: Administrative, Marketing, Auditing, some of the Commercial, Logistics, and third parties, which had not initially participated, did not agree, and, at times, the activities had to be suspended until they were reviewed, validated, and solved.

The figures related to stock-out and returns were diagnosed and evaluated to improve customer service, in terms of product availability in the shelves. Regarding human talent, the training needs of both parties were identified, and new skills developed to improve profiles, and, finally, logistics processes were standardized.

This strategic alliance between La 14 S.A. and Negocio Cárnico allowed the companies to optimize the logistical process between them, and it generated collaboration and trust links as a result of the alignment between their databases, facilitating the development of joint business activities. In addition, it improved technological infrastructure, some operating costs, delivery times, and reduced the environmental impact due to the sensible reduction of distribution vehicles in the retail logistics.

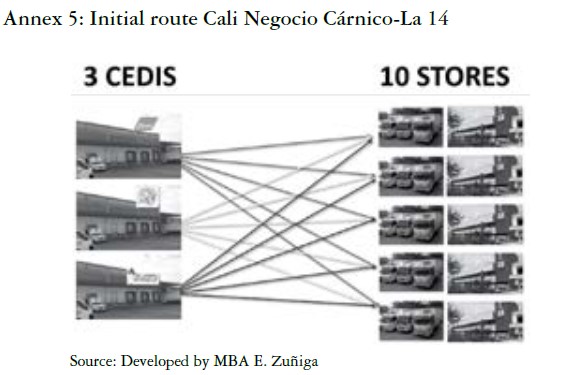

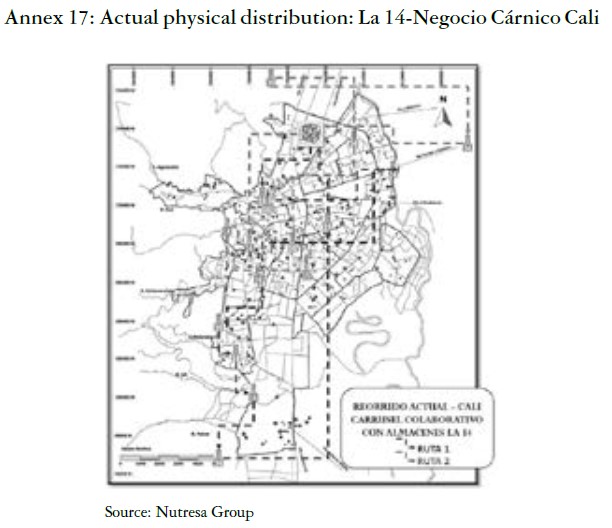

In 2005, La 14 S.A. accounted for 35% of sales on the self-service channel for Negocio Cárnico in the southwestern region of Colombia (Valle del Cauca, Cauca, and Nariño). On the other hand, La 14 S.A. had ten stores distributed in the cities of Cali and Jamundi, which were the geographic space in which the alliance was developed. (See Annex No. 5. Initial route Cali Negocio Cárnico-La 14. See Annex No. 6. Initial route - Cali Colaborattive Carousel Almacenes la 14).

2. THEORETICAL FRAMEWORK

Below, there is an explanation of the topics selected to determine the application of the distribution model:

2.1. Competitive and Supply Chain Strategy (24)

The competitive strategy of a company defines, in relation to its competitors, the group of customer needs seeking to be satisfied with its products and services; likewise, it can address one or more segments of customers. A supply chain strategy determines the nature of the sourcing of raw materials, the transport of materials to and from the company, the manufacture of the product or operation to provide the service and distribution of the product to the customer, together with any tracking services, and a specification indicating whether these processes will be carried out in-house or subcontracted.

Strategic adjustment means that both companies must have their goals aligned, refers to the congruence between the customer's priorities that the competitive strategy expects to satisfy and the supply chain capabilities that the supply chain strategy wants to build -Chopra Sunil.

Supply chains must achieve dynamic aligning, so they can keep up with customers and consumers and evolve over time.

"A value chain emphasizes the close relationship between functional strategies within the company, each function is crucial for the company to meet the customer's needs in a cost-effective manner, therefore, the various functional strategies cannot be formulated in isolation, must be adjusted and supported each other for the company to succeed" (25)

2.2. Supply Chain Network Design (26)

When designing a distribution network, the needs to be met by the customer and the cost to meet them must be considered, some key needs are response time, the variety and availability of the product, visibility of the order and reverse logistics. Other costs to consider are inventories, transportation, and information management.

"The Collaborative Carousel is giving a special service to a special customer, is segmenting the service, is efficient in delivery that benefits the customer and supplier, is a win - win situation for both, as we offer an improved frequency and at the same time optimize the distribution center resources." Ernesto Diaz, -Manager Zenú Cali.

2.3. Customer Satisfaction and Supplier Needs (27)

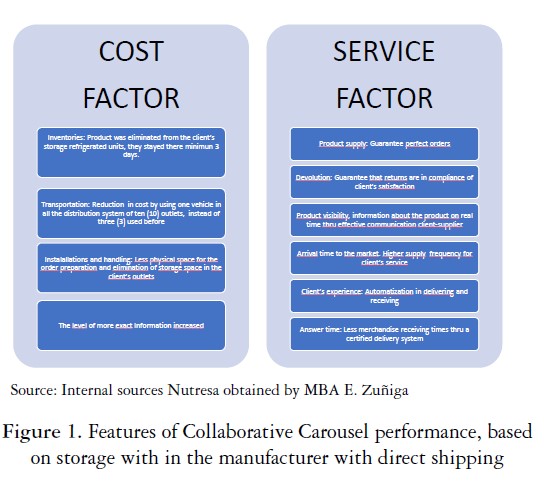

A model like the Collaborative Carousel focuses on:

1. Response time. Shorter times in the receipt of goods through a certified delivery system.

2. Availability of the product. Guarantee the best level of service (decrease the rate of spent products at point of sale).

3. Customer experience. Automation to place and receive orders.

4. Time to reach the market. Increases customer service frequency.

5. Visibility of the order. Information of the order in real time, through effective customer-supplier communication.

6. Returnability, Reverse Logistics. Ensure that returns of goods are certified when they do not generate customer satisfaction.

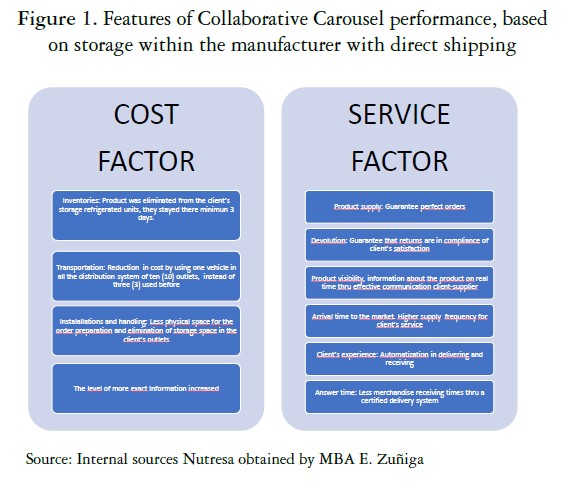

The strategic focus of the design of the COLLABORATIVE CAROUSEL model is, on one hand, to satisfy the needs of the client (better level of service), and, on the other, to increase the efficiency of the chain, through lower costs. Under this operating model, the product is sent directly from the manufacturer to the final consumer, avoiding the retailer; its great advantage is the ability to centralize inventories at the manufacturer. It can add demand throughout the retailers it provides, as a result, the supply chain is capable to provide a high level of product availability with low levels of inventory, also offers the manufacturer the opportunity to produce with low levels of stocks, as well as offers the manufacturer the opportunity to postpone customization until the customer places the order, save on the fixed cost of facilities by using direct shipping. In addition, this type of shipment provides a good customer experience by delivering to your location, if deliveries are not partial. (28)

The performance of direct shipping, with respect to several dimensions applied to the case, can be seen in Table 1: Performance characteristics of Collaborative Carousel, based on storage in the manufacturer with direct shipping.

2.4. Definition of the Collaborative Logistics Model (29)

The joint analysis between the customer and the supplier allows to improve the logistic efficiency in each of the activities, through the application of a collaborative model in which trust is the basis for its sustainabi-lity. Let us see what this involves:

1. Logistical aspects. Continuous resupply, timely assortment, and efficient receipt.

2. Commercial aspects. Efficient order, attention to consumers, and sales growth.

3. Strategic support: Differentiated service based on trained logistics assistants.

4. Consumer satisfaction: Companies acting together, control of baskets, improvements in the cold chain, and decrease in the level of spent references in the gondola.

2.5. Supply Chain Continuous Resupplying CPR (30)

They are distinguished by customer loyalty, and, in return, the expectation of a high level of dedication and service; all their members try to meet the demand in the most effective way; the parties, including the outsourced ones, work together to lower costs, meet demand, and constantly improve their delivery times and services. The most distinctive feature of this type of chain is that customers have a real collaboration purchasing behaviour, and processes are participatory, standard, and re-plicable; in other words, "one happy end customer is a happy customer for everyone".

Members of such chains enter into joint investment societies and projects; planning and management of supply facilitates balancing with the demand, freely sharing in both directions, forecasting information that will help improve performance, which is a common cause; reliability and credibility are also essential ingredients for the success of such chains.

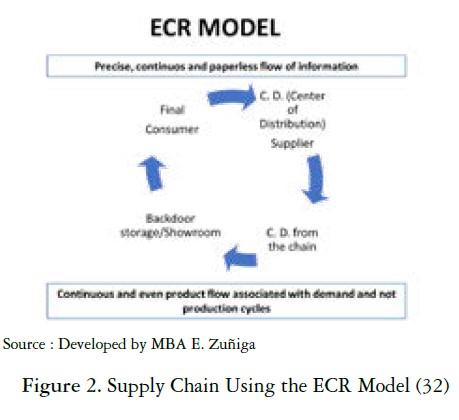

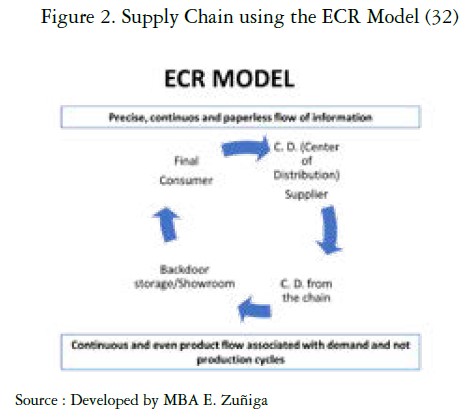

2.6. Efficient Consumer Response (ECR) (31)

Strategy of the mass consumption industry in which industrials and merchants work together to offer greater added value to the consumer, respond to real demand, maximize satisfaction, and reduce total operating costs.

The strategies followed by an ECR Model are as follows:

1. Continuous replenishment. Modification of the current supply chain, changing from a push system to a pull one to respond to real costumer's demand.

2. Efficient assortment. Optimization of the use of the space at the point of sale, gondolas; offering consumers the products that they really need.

3. Efficient Promotion. Defining new promotion schemes ensuring a greater impact on consumers, without generating additional costs for product management.

4. Efficient introduction of products. To optimize investments made in the development and launch of new products, reducing the percentage of failed market entries.

2.7. Collaborative Planning, Forecasting and Resupply CPFR (33)

Standard, global, and neutral business process in which supply chain partners coordinate plans to reduce the gap between supply and demand, sharing the benefits of a more efficient and effective operation; CPFR is a collaborative approach to increase product availability, while reducing inventory through the supply chain; its objective is to increase the availability of products and to decrease the inventory level; it also involves an interaction between the participants of the production chain and retail, based on collaborative management in the planning processes and information exchange. A successful CPFR requires partners in business strategies to operate in an integrated manner.

The CPFR has its origin in the strategy of efficient response to consumer ECR, a management concept based on vertical collaboration in production and distribution processes, with the aim of achieving an efficient satisfaction of consumer needs, with supply chain management (SCM) and category management (CM) as its main components.

'The goal of CPFR is to achieve the collaboration of the entire supply chain, around the commercial partners who have contact or have effect on the value of the product going to the final consumer' - Supply Chain Management.

3. EFFECTIVE COLLABORATION IN THE SUPPLY NETWORK' CONCLUSIONS

In 2005, the logistic operation of the Collaborative Carousel (34) model began, once Eberto Zúñiga and Abel Cardona agreed to carry out a pilot test at one of La 14 S.A. stores, in the city of Cali. The result of this experience was a collective learning that allowed the parties to identify opportunities for improvement in the logistics operations that, shared with their work teams, formed the basis for the implementation of the model in all the stores.

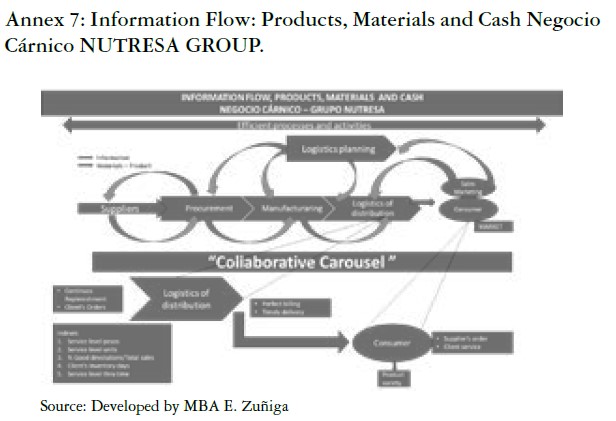

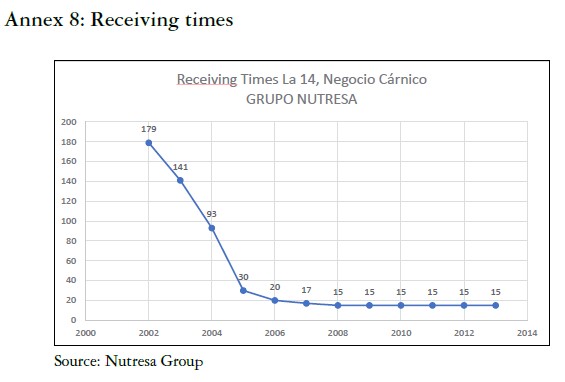

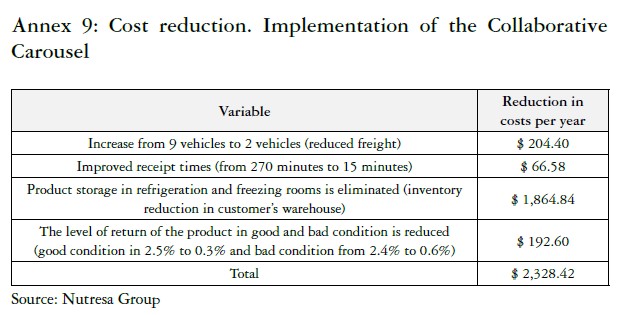

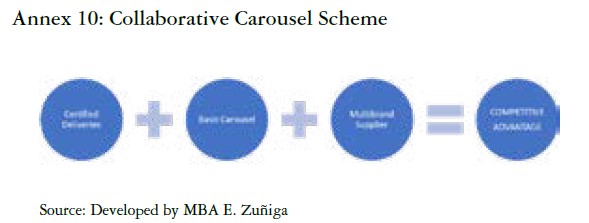

Collaborative Carousel was a program designed for the effective collaboration between Negocio Cárnico and La 14 S.A. (see Annex No. 7 Information Flow: Products, Materials and Cash Negocio Cárnico NUTRESA GROUP). Its main objective was to improve the orders delivery times, reception and product supply of Zenú, Rica Rondo, and Suizo brands in the ten stores of La 14 S.A., in order to offer a better quality of service to the final consumer (See Annex No. 8, Receiving times), and to reduce logistical costs associated with the logistics operation with the client (See Annex No 9, Cost reduction. Implementation of the Collaborative Carousel). This process was the result of the integration of three elements into the logistics chain: Certified Delivery Program, Basic Carousel, and Multibrand Dispenser.

Each of these is explained below (See Annex No. 10). Collaborative Carousel Scheme.

3.1. Certified Delivery Program

In 2005, Eberto Zúñiga proposed to Abel Cardona to operate the Collaborative Carousel model, based on a certified delivery scheme. With the process of certified deliveries (35), Negocio Cárnico and La 14 S.A. managed to minimize the costs associated with verification, delivery time, merchandise handling, accounting notes, returns and repetition of operations through the logistics process. This was how Negocio Cárnico used in this model a logistic service provider, Cargacoop (36), considered as an integral part of the program.

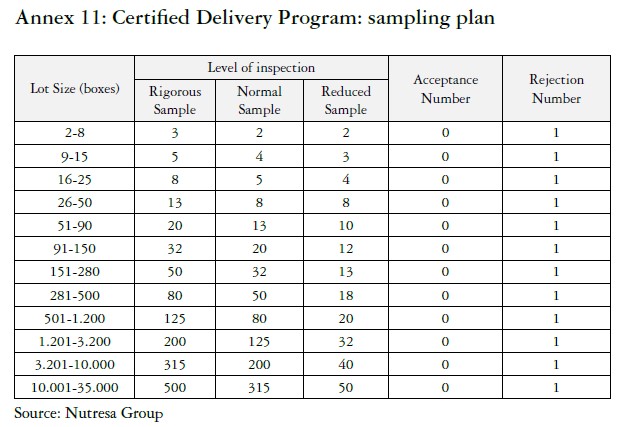

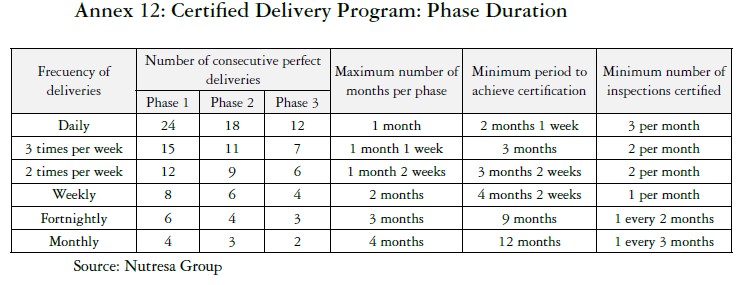

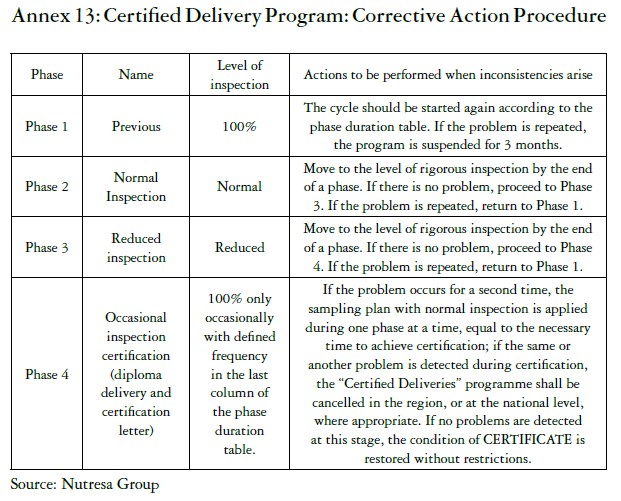

During the second quarter of 2005, based on experiences with other customers, Eberto Zúñiga proposed that companies should align themselves in orders placement, supply schedules, and real-time communications between the points of dispatch and receipt. As a result of this need, a training space was started to contribute to the improvement of the logistical process between the parties. This process was carried out in different phases, as follows: through a sampling plan that facilitated the monitoring of the inspection level in the Certified Delivery Program (See annex No. 11, Certified Delivery Program: sampling plan), a specific duration of each step for the certification process was also agreed, taking into account the frequency of delivery (see Annex No. 12, Certified Delivery Program: Phase Duration). In the phases there were tolerance levels, safety conditions, and corrective actions within which decertification was considered. (See Annex 13, Certified Delivery Program: Corrective Action Procedure).

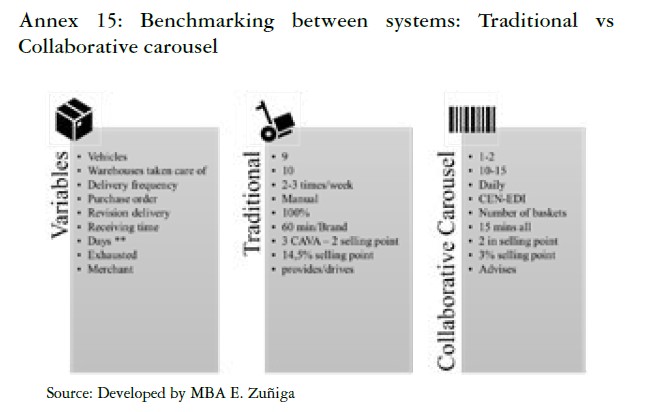

At La 14 S.A. stores, the contents of each basket of the delivered order were checked, so the delivery time took more than 90 minutes per brand; with the new model, only the number of baskets was counted, and the delivery time was reduced to only 15 minutes in the delivery of the three brands.

"The Collaborative Carousel provided a streamlined service and better organization of internal processes such as the chain itself, generated greater customer reliability in our processes". Maria Teresa Restrepo - Suizo Manager Cali.

This is how certification was achieved during the last quarter of 2005. This generated a greater degree of confidence among parties, as fewer items were checked per invoice to the point where only the total number of delivered baskets were verified, and not the detailed order. By the end of 2005, the parties achieved the following benefits in terms of time reduction: attention, waiting, unloading, verification, as well as product handling and administrative 'wear and tear' in dispute resolution; the quantity of products in the delivery was assured, and a relationship of strategic allies was consolidated between Negocio Cárnico and La 14 S.A.

3.2. Basic Carousel

It consisted of specializing a single vehicle to deliver the new brands at each of La 14 S.A. stores. Before implementing this model, there were two previous phases:

Phase 1 - Year 2003: nine vehicles were required (three for each of the companies, Industria de Alimentos Zenú S.A., Rica Rondo Industria Nacional de Alimentos S.A, and Suizo S.A.); deliveries were made at different times and frequencies.

Phase 2 - Year 2004: three vehicles were required (a single vehicle fleet for all companies), this meant moving to a single delivery schedule, unifying its frequency.

In 2005, with the operation of the model, a vehicle was required, a unified delivery schedule and the frequency of deliveries increased from 2 to 6 times per week.

3.3. Multibrand Dispenser

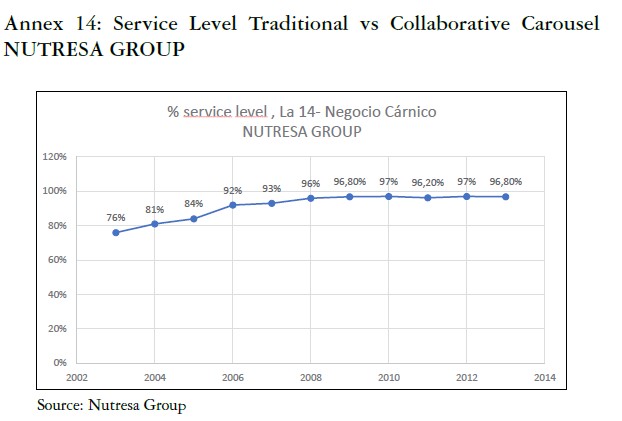

During 2005, Mr Giovanni Vico, manager of Rica Rondo Industria Nacional de Alimentos S.A., proposed to Abel Cardona and Eberto Zúñiga to complement the model with the figure of a person trained by the parts, so that, once the order was delivered, it was supplied in real time. This was widely accepted by the parties, as it ensured the decrease of depleted products at the store; it also eliminated storage in cold rooms, and reduced excessive handling of products before reaching the gondola. This allowed us to increase the efficiency in the service level of La 14 S.A. (See annex No. 14, Service Level Traditional vs Collaborative Carousel NUTRESA GROUP).

'The collaborative carousel resulted in the understanding and comprehension of a process providing significant time savings in daily tasks that had a direct impact on the end customer, the great beneficiary and for which we continued to look for continuous improvement in our processes', Vladimir Arenas, Logistic Coordinator of La 14 S.A.

During 2006, trust between the parties reached such a high level that processes flowed naturally; this fact improved operational efficiency, every time new sales points were opened for La 14 S.A., the model was immediately implemented.

It was thus the integration of the three elements: Certified Delivery Program, Basic Carousel, and Multibrand Dispenser, which meant the basis that over time became the operational efficiency of the entire model (See Annex No.15, Benchmarking between systems: Traditional vs Collaborative carousel).

The Collaborative Carousel supply chain strategy required most of the Negocio Cárnico distribution to be outsourced, so it had to be both inward and outward oriented. It identified not only what Negocio Cárnico and La 14 S.A. should do, but also the role of the third parties to whom it subcontracted for the accomplishment of the tasks. This strategy defined which transport, operation, and service functions should be developed in the future, including greater control over the overall supply chain structure, and this ended up being a logistics operations strategy.

4. SOME LESSONS LEARNED IN THE IMPLEMENTATION OF THE MODEL

• To have the acceptance and participation of senior management in both companies.

• To unify the form of measurement based on the definition of GS1 Colombia.

• Adjustment of databases as a transactional facilitator between companies.

• For companies to look at the needs of the consumer on the same side of the table.

• Flexibility of the parties to meet consumer needs.

• Knowledge and participation of all areas of companies and third parties for common definitions.

• To understand the reality of the parties and, if necessary, to modify the defined processes by agreement.

• To start pilot testing at a customer sales point to ensure the basic operation of the model.

• Timely, accurate, and real-time communication.

• To act as open books to seek the timely solution of issues.

• Joint solution of non-conformities and socialization of new-found opportunities.

• Definition of business sponsors, with autonomy, for the implementation of improvements and decision-making.

• Respect for process and model, as defined and agreed by the parties.

• Use of technology as model facilitator.

• To formalize the protocol of the agreement (basic format GS1 Colombia).

• Joint socialization of the model in all parts (customer-supplier and logistics service provider).

• To ensure that the execution of the model does not depend on the duty officer.

• Periodic evaluations (recommended monthly) and process adjustments.

• Recognition and permanent feedback to the direct executors of the model.

• Resignations of participants if they facilitate and provide quantitative benefits to the model as a whole.

• Certify the model, once the number of deliveries defined in the phases of the model (model GS1 Colombia) is exceeded.

4.1. The Future of the Collaborative Carousel Alliance

As part of the dynamics presented by the market, the market invited the participating companies of the Collaborative Carousel model to review what was happening in their sectors, in order to visualize opportunities that would allow them to anticipate and prepare for these new scenarios, we shared some cutting-edge decisions that companies had to make.

Almacenes La 14 S.A.

In 2009, La 14 S.A. decided to change its strategy, seeking to be recognized as a Latin and world-class chain. They defined, in their initial expansion plan, Bogota as the most important region of the country, where they expected to inaugurate two more stores in the next five years (20142018). To strengthen its IT structure, since 2012, its board of directors approved the SAP project as an integrative ERP and connectivity with its customers and suppliers. They hope to go live with this implementation (retail and financial) at the end of the second half of 2014. In the short and medium term, managers of La 14 rule out a possible sale and alliances with third parties. As part of its strengthening in the medium range, they have considered the construction of a distribution centre in Cali, to take care of everything related to mass consumption. They say that customer service is, and will continue to be, their main factor in differentiation from their competitors, and they are leveraging their new strategic dynamic to dynamize new openings in other regions of Colombia.

Negocio Cárnico of the Nutresa Group

Since 2008, Negocio Cárnico provided to their processes a comprehensive management model, based on strategic readings of the commercial environment. They declared the consumer as their focus and defined his century-old strategy that pursued to double sales by 2020, reaching them in 2013. They made statements on leadership to leverage new challenges, promulgated their core and enabling capacities; emphasized the desirability of continuing to strengthen the required culture, as part of adjusting their processes, to be more competitive and to ensure the flow of information between the work teams. Starting in 2014, they redefined its enabling process structure, giving way to the beginning of structuring a fully mature supply chain management.

4.2. Future of the Collaborative Carousel model

For Abel Cardona, developing the model inside La 14 S.A. did not constitute a strategic turn of the operation, so he invited other suppliers to know and implement the model advanced with Negocio Cárnico.

Instead, for Eberto Zúñiga, it became an opportunity to visualize Negocio Cárnico at a higher stage, to enable it to develop Collaborative Carousel, and to strengthen it as a program to offer logistics services to other national and international supply chains; socializing it with other companies in the region, both industrial suppliers and commerce in general, so this practice could lead to improve other supply chains.

With the exercise carried out with La 14 S.A., and the possibilities offered by the market, through the different distribution channels, the invitation to consider alternatives such as diversification into collaborative processes that would support the model by presenting this relationship where customers, suppliers, channels, materials to be distributed compatible and the wide range of frequency attention could be used and applied to be built in into other possible product categories.

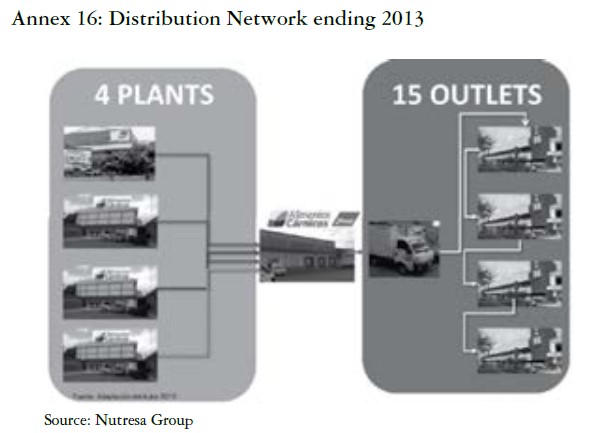

The strength and proper construction of the model presented total consistency, since between 2008 and 2013, La 14 S.A., increased its stores in Cali by five, and this new market condition involved the inclusion of an additional vehicle by Negocio Cárnico, which allowed them to ensure delivery schedules (according with the number of new sales points to attend), and the new equivalent volume of products.

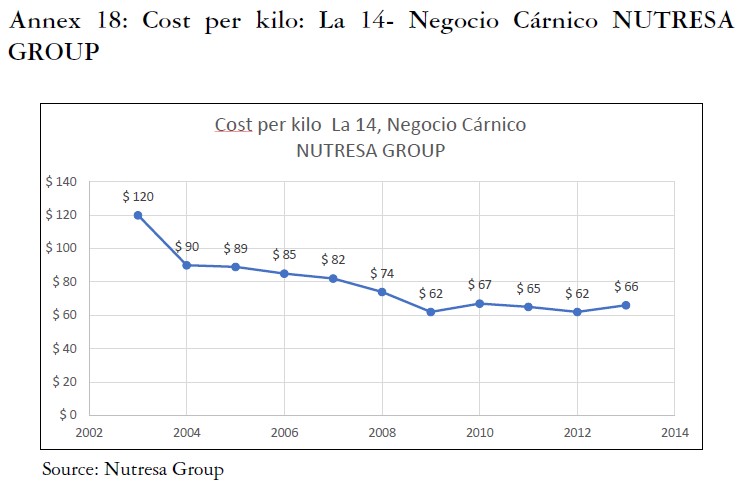

This did not affect the level of service, distribution costs, receipt times, and other associated indicators, as can be seen from the annexes. To explain the service model at the end of 2013, you can see annexes No. 16 and 17. Routes Carousel Collaborative Negocio Cárnico and La 14, year 2013. Likewise, for greater understanding we share annexes 18, which show the behavior of the cost per kilo transported between the years 2003 and 2013.

Will this model allow logistics service providers and/or suppliers to serve other supply chains than the meat sector? Can strategies such as Efficient Consumer Response (ECR) (37) and Planning, Demand Forecasting Collaborative resupply (CPFR) (38), which are recognized global practices applied to mass consumption, be successfully applied in this model? Can this logistic model, from its versatility, be used to serve new channels or ensure multi-channel attention in new distribution schemes?

5. REFERENCES AND NOTES

(1) Negocio Cárnico is the name given to the companies that make up the food business (cold meats) of the Nacional de Chocolates Group. It is composed of companies like Industrias de Alimentos Zenú S.A.S. and Alimentos Cárnicos S.A.S.

(2) The Nutresa Group. Matrix of the Set of companies dedicated to the production and marketing of food, formed by six businesses: Meat, Chocolates, Biscuits, Coffee, Pasta, and Ice Cream. These, in turn, consist of 51 national and international distribution companies and networks. As a group, businesses share a coherence and unity in their vision while remaining autonomous in their respective operational and market management. (Bulletin issued by Grupo Nutresa, Communications area. Medellin, Thursday, April 6, 2006).

(3) Asociación Nacional de Empresarios, ANDI. Most important business guild in Colombia. It is a non-profit organization and aims to disseminate and promote the political and social principles of a healthy system of free enterprise. It has its main headquarters in Medellin, with branches in the main cities of Colombia. (www.andi.com.co).

(4) EDI, Electronic Exchange of Documents. (www.gs1co.org).

(5) CEN, Electronic Business Center. It is the structured transmission of data between organizations by electronic means. It is used to transfer electronic documents or business data from one computer system to another. (Carvajal S.A.).

(6) IAC - LOGYCA is an organization specialized in logistics, offering consulting services, measurements and training, supporting its management in the promotion and development of best logistics practices. With a clear orientation of generating logistical knowledge, and building communities around it. (www.logyca.org).

(7) Efficient logistics of the delivery process to the different points of sale of a customer, delivering them in sequence and complying with the schedules agreed with each of them, it ensures exclusivity of the vehicle for the customer's route, and this ensures it will be received at the agreed time. (Good Logistic Practices of Negocio Cárnico).

(8) Data supplied by Almacenes La 14 S.A. Communications Area.

(9) www.edunet.edu.co. Definition of Cacharrería: A store that sells ordinary earthenware, junk and other items.

(10) Data supplied by Alimentos Cárnicos S.A.S. 2013.

(11) ERP, Enterprise Resource Planning, a comprehensive business management system designed to model and automate processes in a company. Taken from www.adpime.com.

(12) Data supplied by Industria de Alimentos Zenú S.A.S.

(13) Data supplied by Negocio Cárnico del Grupo Nacional de Chocolates 2013.

(14) Opcit pag. 1.

(15) Alimentos Cárnicos SAS. Taken from: http://www.alimentoscarnicos.com.co/index.php/informacion-institucional/nuestra-historia.

(16) http/ www.gs1pa.org. The reverse logistics is the set of logistic activities for the collection, dismantling and processing of used or damaged products, parts of products or materials with a view to maximizing the use of their value and, in general, its sustainable use. (Angulo, 2003).

(17) http//www.ricarondo.com.co, http//www.zenu.com.co, www.suizo.com.co

(18) Source The Nielsen Company. Retail variables interpretation Index Nielsen Adviser. Supermarket Chain definition: Four or more outlets working under the same legal name. They are: Hypermarkets with an area of more than 5.000 square meters (sm) and other chain supermarkets with an area of less than 5000 sm

(19) Definition of Independent Supermarkets, according to The Nielsen Company: establishment as self-service regardless of its size.

(20) Definition of distributors, according to Negocio Cárnico: strategic ally whose fundamental reason is to achieve business objectives (distribution, visibility, volume and prices for brands in all shops in a given geographical region or specific customer group)

(21) Definition of wholesalers, according to Negocio Cárnico: commercial establishment that performs the work of intermediary in the commercialization of products for wholesale sale to retail and minority customers.

(22) Definition of shops, according to The Nielsen Company: establishments attended by a clerk behind a counter. + 50% of retail sales.

(23) Electronic Business Center: Structured data transmission between organizations by electronic means. It is used to transfer electronic documents or business data from one computer system to another.

(24) Chopra Sunil y Meindl Peter. Administración de la Cadena de Suministros. Edición 3. México. - Desempeño de la Cadena de Suministro: lograr el ajuste y el alcance estratégicos. Año 2008, Cap. 2, p.24.

(25) Ibid., p.25.

(26) Ibid., Cap. 4, p. 76 - 77.

(27) Chopra Sunil y Meindl Peter. Administración de la Cadena de Suministros. Edición 3. México. - Diseño de Redes de Distribución y aplicaciones de comercio electrónico. Año 2008, Cap. 4.

(28) Ibid., Cap. 4, p. 81.

(29) Ibid., Cap. 4, p. 82 - 83.

(30) Zúñiga Rodríguez, Eberto. Conference: Abastece 2007. Lugar: Fenalco Valle del Cauca. Año 2007.

(31) Gattorna, Jhon. Cadenas de Abastecimiento Dinámicas. Capitulo 5 "Supply Chains de reabastecimiento Continuo" Editorial ECCOE Ediciones. Colombia Año 2009.

(32) http: www.gs1.org - GS1 Colombia. Año 2008.

(33) http: www.gs1.org - GS1 Colombia. Año 2008.

(34) http: www.gs1.org - GS1 Colombia. Año 2008.

(35) Certified Deliveries: strategic alliance through which the supplier and the customer undertake to carry out all the necessary operations to guarantee the final consumer total reliability in terms of product quality, the information it provides, its physical handling, and the accuracy of the documents covering each transaction (GS1 Colombia).

(36) Cargacoop: Company providing logistic transport services for Nacional de Chocolates Group.

(37) ECR: Efficient Consumer Response strategy of the mass consumer industry, in which industrialists and merchants work together to provide greater added value to the consumer (http://www.webpicking.com/notas/wanke.htm. - gs1Colombia).

(38) CPFR: Collaborative Planning, Forecasting and Replenishment (Planning, demand forecasting and collaborative resupply) Extension of the ECR, whereby manufacturers and retailers share systems and processes for forecasting sales (http://www.webpicking.com/notas/wanke.htm Colombia).

6. CHARTS AND FIGURES

7. ANNEXES